- Prop Traders Weekly

- Posts

- 👀 AWS Outage Takes Down ProjectX and Most of the Futures Industry

👀 AWS Outage Takes Down ProjectX and Most of the Futures Industry

Lets get ourselves prepared for the week ahead!

Hi guys, it’s Kieran. Another week is upon us and the markets are open, so lets get into it.

📢 Prop Firm Industry News

The global AWS outage on Monday caused a catastrophic ProjectX outage and total chaos across the industry.

There is currently a global internet outage with one of the backbones of the internet (Amazon Web Services) that’s affecting trading on ProjectX. We will keep you updated as we get more information.

— The Futures Desk (@TheFuturesDesk)

1:36 PM • Oct 20, 2025

After 2 days of technical issues, ProjectX accounts, across all the major firms, were still missing data and showed incorrect trade history. Firms were supposedly left in the dark to figure out how to make it right with their customers.

🚨 ProjectX is still struggling to recover from the recent AWS outage.

All firms using the platform are affected, and many have voiced frustration. Trading on ProjX may remain disabled until the issue is resolved.

Honestly, this whole thing’s turning into a bit of a shitshow

— BrianStonk (@thebrianstonk)

11:06 PM • Oct 21, 2025

Heres a great thread of firm’s public responses to the situation:

Latest @projectxtrading Updates from Individual Firms. Updated 8:50 AM EST

🧵— Jmu (@jmutrades)

12:53 PM • Oct 22, 2025

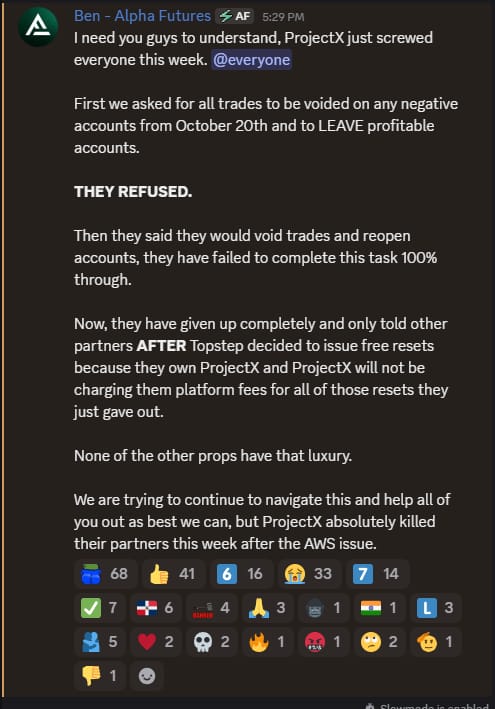

Alpha Futures put out a scathing statement on the situation:

ProjectX statement on the situation.

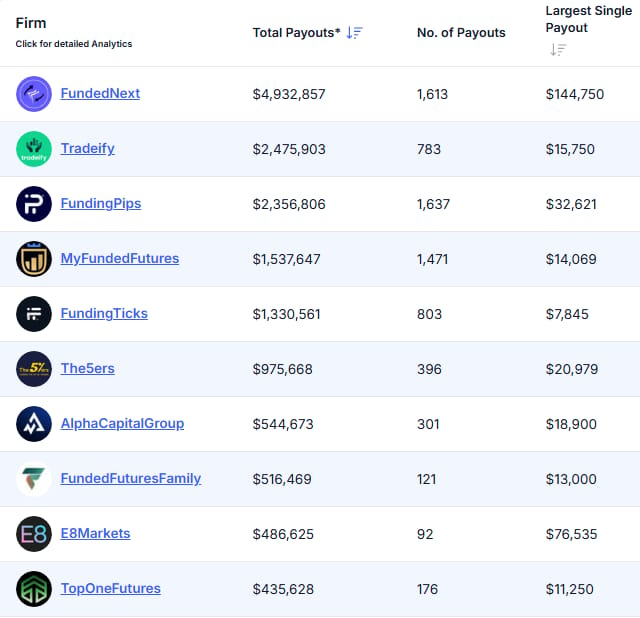

From Payout Junction, here are the firms who paid out the most over the last 7 days 🏆️.

🔥 Monitor prop firm payouts LIVE on Payout Junction - https://payoutjunction.com.

🕜 Red Folder News

Here are this week’s red folder news events. Another week of US government shutdown, so lots of data will be delayed, however the Fed is meeting on Wednesday and the market is expecting another rate cut. Expect chaos if they do not deliver one.

Time in CET

📈 The Macro View

S&P 500 breaking out

After a couple of months of consolidation, a lower than expected CPI reading sparked a breakout to new all times in the equity markets.

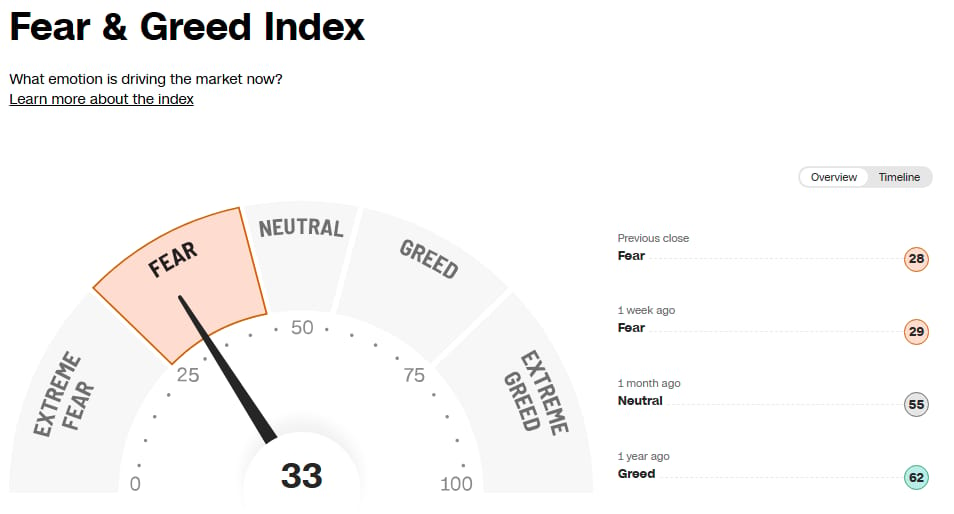

All Time Highs with Fearful market sentiment

A breakout when the market is fearful is a rare perfect setup, as most people are not in the trade. Noting works 100% of the time, but these conditions are about as good as they get for buying all time highs using contrarian market sentiment as a signal.

Always keep an open mind though

Bank of America put out a report highlighting the fact that a 25% drop from here only gets us back to the liberation day lows. We’ve come a very long way in a short space of time, so a huge pullback to test some of that rally would not be out of the ordinary.

Gold reversal

Last week we noted that Gold was totally detached from it’s technicals. Well, during the week it ran it’s highs and put in a huge reversal candle, 8.5% top to bottom. Silver also -10% on the week. Dangerous times for metals longs. Gold and Silver down another 1.5% this morning.

OK guys that it from me, have a great week!

Kieran

What did you think of this week's newsletter?Vote below and you'll be given the opportunity to leave more detailed feedback. Help improve the newsletter! |

Enjoy trading related newsletters? Try the Market Journal 👇️

Monitor prop firm payouts LIVE on Payout Junction 🔥

New here? Join Our Newsletter

Reply