- Prop Traders Weekly

- Posts

- 👀 FTMO launches its first 1 Step program

👀 FTMO launches its first 1 Step program

Lets get prepared for the week ahead

Hi everyone, it’s Kieran. What a crazy week it was. Starting with an industry-wide Tradeovate outage, and ending with a historic market meltdown.

This week is also starting off with a bang, as CFD industry leaders FTMO, have just announced their first ever 1-Step Challenge.

Targets and pricing 👇️

This has been a long time coming. Cool to see them finally dipping their toes into a different ruleset!

📢 Firm Announcements via promojunction.io

• Tradeify announced it’s expansion into crypto trading with the upcoming launch of Tradeify Crypto.

• Tradeify, LucidTrading, FundedNext Futures, Blue Guardian Futures, and Earn2Trade all confirmed that recent NinjaTrader and Tradovate data issues have been fully resolved, with adjustments applied where required and systems now stable.

• Top One Trader temporarily adjusted metals leverage to 1:3 and restricted weekend holding due to elevated volatility, with plans to revert once conditions stabilize.

• Take Profit Trader shared updates on PRO+ live market trading, noting temporary adjustments remain in place while working with Tradovate following recent platform disruptions.

• My Funded Futures introduced an instant upgrade path to SimFunded for traders who have hit all targets, removing the need for additional review steps.

• Funded Trader Markets confirmed crypto trading is now live, offering over 40 crypto pairs with leverage up to 1:5 on BTC and ETH.

• Alpha Futures announced a new proprietary trading platform currently in development, built in house for Alpha traders. The firm also launched a Trader of the Month initiative rewarding the highest percentage gain each month with merchandise, media exposure, and interviews.

• Goat Funded Trader confirmed cTrader is now live alongside MT5, TradeLocker, MatchTrader, and Volumetrica FX.

• Blue Guardian announced new Instant Funded account offerings up to $400K with a 90% profit split, account fee refunds, and scaling up to $4M.

• FundingPips launched new 200K account sizes across its 2 Step Pro and Zero models, with swap free add ons now available.

• Seacrest Markets confirmed gold trading has resumed following a temporary liquidity provider halt.

To get live announcement alerts, head over to promojunction.io.

From Payout Junction, here are the firms who paid out the most over the last 7 days 🏆️.

🔥 Monitor prop firm payouts LIVE on Payout Junction - https://payoutjunction.com.

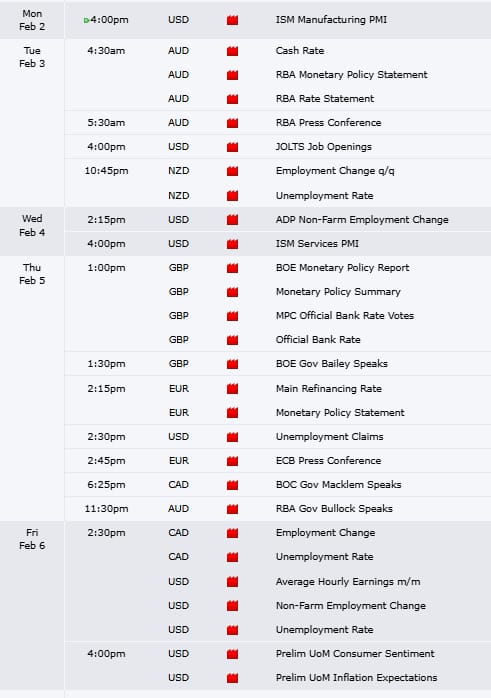

🕜 Red Folder News

Here are this week’s red folder news events. Lots of major releases including Non-Farm Payrolls on Friday, ADP Employment numbers on Wednesday, and Jolts on Tuesday.

Trump last week announced that he has nominated Kevin Warsh as new Fed Chair. He is expected to take over responsibility from May, however the Senate still needs to sign off which could involve delays amid debates on Fed independence

Time in CET

📈 Markets

Silver’s insane retracement

There are so many crazy charts out there after last week’s metals melt-down. This single candle sliced through the 61.8% Fib of the December breakout like butter.

Gold was dumped in historic fashion

The Gold ETF (GLD) saw its biggest one-day drop in history with a 10.3% decline.

Gold Technicals

Taking a step back, lets assess the situation.

The trend line from the September breakout remains intact and currently sits around $4,600. Price briefly dipped below the 21-day MA (~$4,750) on Friday but managed to close back above it. The 50-day MA is now around $4,470, while first resistance is seen near $5,000.

So, no major technical damage done yet, although futures are down again this morning. Shakeout or reversal? Not sure, but the uptrend remains in-tact… for now.

OK guys that’s it from me. Hope you have a great week!

Kieran

What do you think of this week's newsleter? |

Enjoy trading related newsletters? Try the Market Journal 👇️

Monitor prop firm payouts LIVE on Payout Junction 🔥

Real-time prop firm discounts, flash deals and announcements 👇️

New here? Join Our Newsletter

Reply