- Prop Traders Weekly

- Posts

- 👀 Futures Prop Firms Enter a New Phase of Competition

👀 Futures Prop Firms Enter a New Phase of Competition

Lets get ourselves prepared for the week ahead!

Hi guys, it’s Kieran! Another week is upon us and the markets are open, so lets get into it.

📢 Prop Firm Industry News

Competition in the futures side of the industry continues at a rapid pace, as many of the major firms last week announced or teased new plans. This rapid evolution of program rules reminds me of the forex side, a couple of years ago, when firms where updating their plans on a weekly basis. That didn’t end well, however the operating environment is very different nowadays, with barriers to entry higher, more regulatory eyeballs on the space, and greater technology innovation, so lets enjoy it!

Last week alone, MyFundedFutures updated all of their plans:

🚨 HUGE NEWS 🚨

Meet Core, Scale, and Pro — our new funding lineup 👇

✅ 1 evaluation for all plans

✅ $100k payout cap

✅ 5 sim-funded accounts for $50k (was 3)

✅ $0 activation fees

✅ No DLL or consistency in sim-fundedCore. Scale. Pro are live today. Check them out now!

— MyFundedFutures (@MyFundedFutures)

1:17 PM • Jul 22, 2025

FundedNext Futures launched their new rapid challenge:

Dear Traders,

We’ve listened. We’ve learned. And we’ve built a model from your feedback.

Say hello to the FundedNext Futures Rapid Challenge, a brand new model designed from the ground up based on everything our Futures traders have told us.

And that’s not all. The Futures

— FundedNext Futures (@fnfutures)

12:30 PM • Jul 23, 2025

Khaled, CEO of FundingTicks teased a new plan:

FundingTicks ONE is coming, expect official announcements.

— Khaled (@Khldfx)

3:51 AM • Jul 24, 2025

and Brett Simba, CEO of Tradeify teased something “outside of the box”.

Everyone playing checkers and we playing Chess @Tradeify

Think outside the 📦

— Brett Simba (@BrettSimba)

12:04 AM • Jul 26, 2025

The speed at which the futures prop industry is evolving is exciting. With competition so fierce, ultimately it is us, the traders who benefit! So enjoy the ride and stick to reputable firms.

From Payout Junction, here are the firms who paid out the most over the last 7 days 🏆️.

🔥 Monitor prop firm payouts LIVE on Payout Junction - https://payoutjunction.com.

🕜 Red Folder News

Here are this week’s red folder news events. A packed calendar this week ending with US Non-Farm payrolls on Friday. Other notable events are US advance GDP on Tuesday, the Core PCE price index, which is the Fed’s preferred gauge on inflation on Thursday, as well as the BOJ rate decision. Plenty of market moving events to stay on top of this week, so keep a close eye on the calendar.

Time in CET

📈 The Macro View

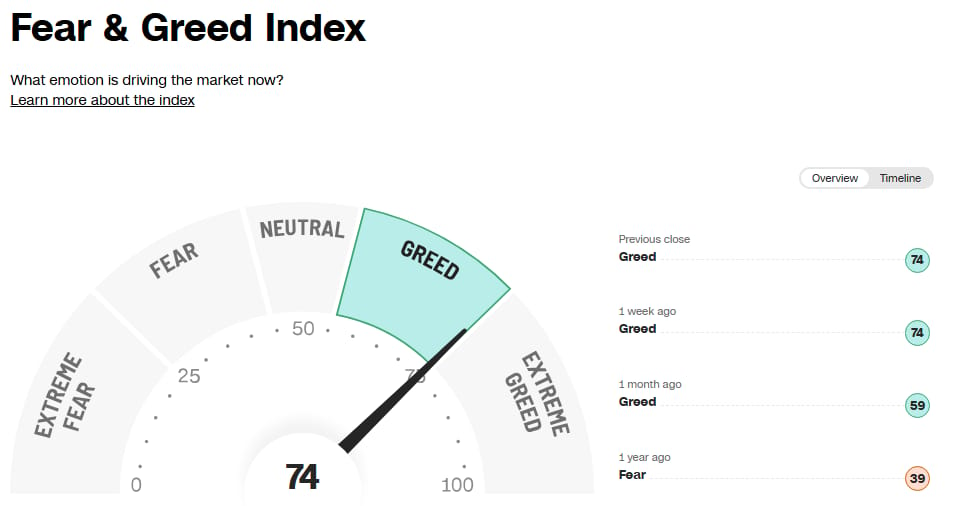

Fear & Greed - Not extreme, yet…

Another green week for the S&P500 and a solid breakout to new all-time highs. With the US-EU trade deal agreed over the weekend, futures are green again this morning, so expect this to tick into ‘extreme greed’ territory this week.

Possibly an opportunity developing for contrarians, however shorting equities is a dangerous game and this index can go far into ‘extreme greed’ territory before we see snapbacks, so trade with caution.

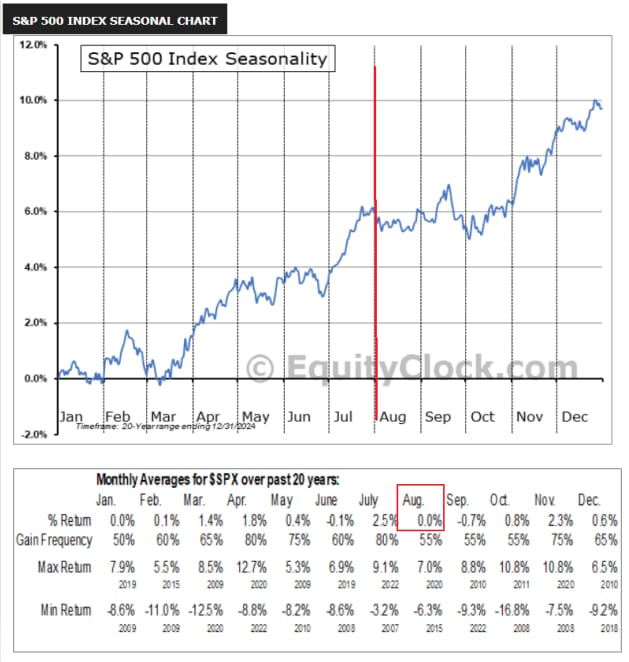

August seasonality

S&P500 July seasonality played out perfectly, with a roaring rally to all-time highs. Let’s look ahead to August, which tends to give us sideways, choppy price action, delivering 0% returns over a 20 year lookback. Keep this in mind if you are considering chasing these highs.

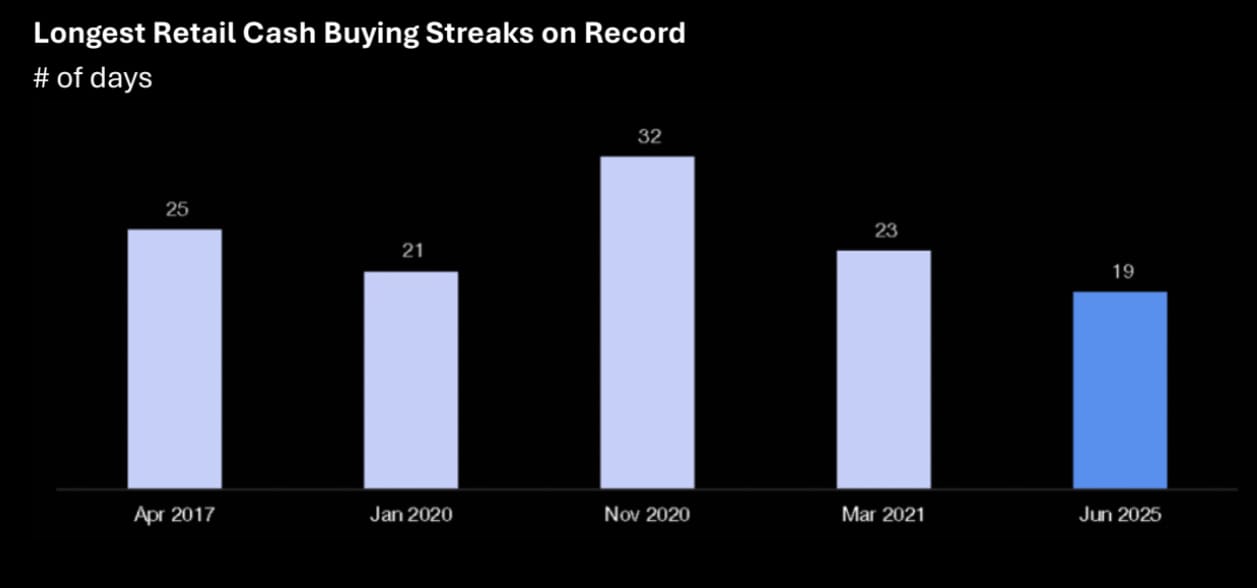

Retail being handed the bags?

As per Scott Rubner of Citadel “retail activity has been a buyer of cash equities for the past 19 straight trading sessions. This is the longest daily buying streak in the past 4 years (since March 2021) and 5th longest streak on record)".

We are at covid levels of retail participation and meme stocks are being FOMO’d again, yet it does feel kind of quiet out here. 🤔

Indeed..

Something ominous brewing.

— The Great Martis (@great_martis)

7:12 AM • Jul 25, 2025

Ok guys that’s it for this week, stay safe out there!

Kieran

📚 Further Reading

How Should Futures Prop Traders Strategically Time Their Payouts to Navigate Buffers and Consistency Targets? This week’s question to PerplexityAI includes:

Buffer Management Strategy

Account Type Timing

Consistency Rule Navigation

Strategic Payout Scheduling

Click the link below!

What did you think of this week's newsletter?Vote below and you'll be given the opportunity to leave more detailed feedback. Help improve the newsletter! |

Enjoyed this newsletter? Try out our friends at The Market Journal 👇️

Monitor prop firm payouts LIVE on Payout Junction 🔥

New here? Join Our Newsletter

Reply