- Prop Traders Weekly

- Posts

- 👀 Multiple Futures Firms Approve Million Dollar Payouts

👀 Multiple Futures Firms Approve Million Dollar Payouts

Lets get ourselves prepared for the week ahead!

Hi guys, it’s Kieran. Another week is upon us and the markets are open, so lets get into it.

📢 Prop Firm Industry News

The futures side of the industry appears to be thriving as multiple million dollar payouts were approved last week. First Candace Lau, got a $1.17 million payout approved and paid by Apex.

Then at the end of the week, Lanto_trades put in 3 back-to-back $500k+days in a row, to secure $1.75m on the week. Absolutely insane numbers from 3 trading days.

The majority of his profits appear to be with TakeProfitTrader, who have approved $360k so far, and confirmed that he was trading on a live account, so should have no issues paying the remainder out.

Great to see payouts of this size getting approved across multiple firms now. If firms are structuring themselves in such a way that payouts of this size are becoming commonplace, then the opportunity to make lifechanging money from prop firms has never been greater. Kudos to these incredible traders, and fingers crossed that firms are prepared to continue paying out these huge sums.

From Payout Junction, here are the firms who paid out the most over the last 7 days 🏆️.

🔥 Monitor prop firm payouts LIVE on Payout Junction - https://payoutjunction.com.

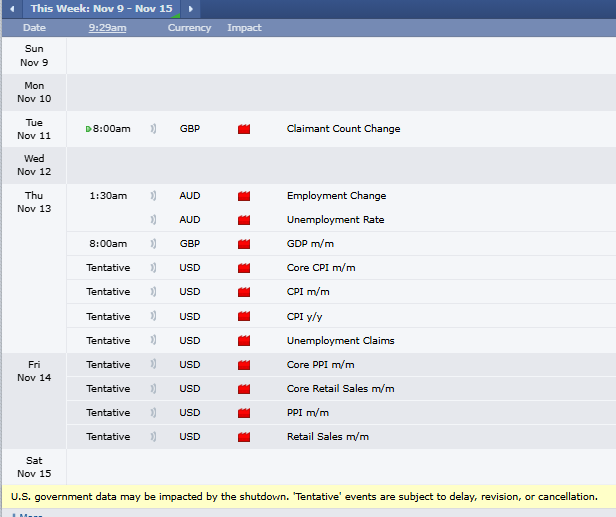

🕜 Red Folder News

Here are this week’s red folder news events. The US Government shutdown continues, so lots of ‘tentative’ events on the calendar again. What would have been a huge week of inflation numbers, is now a very thin week of data.

📈 The Macro View

Tech Bloodbath

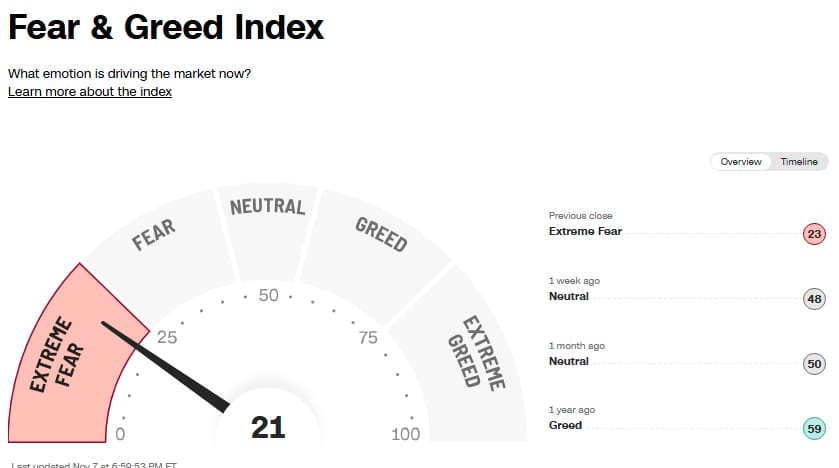

A horror show for big tech last week, and the biggest down week for the Nasdaq since April. Lots of talk of an AI bubble, even in the mainstream media, so this remains an interesting setup for contrarians, but these trades don’t come without risk. We can still get much more extreme from here.

The dip is still getting bought

Despite the sell-off, ETF buyers remain in Buy-the-dip mode. Inflows were still positive on the week, in fact $13bn net went into SPY (S&P500) alone. As long as the dip buyers are still playing, this can still be considered a pullback, rather than a reversal.

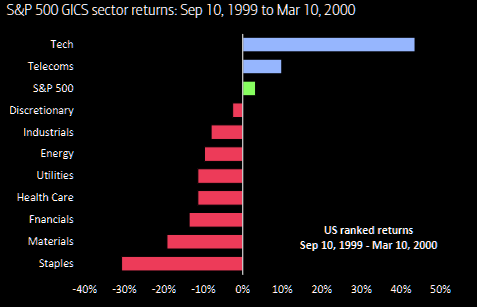

Market breadth when the tech bubble burst in 2000

Looks worryingly familiar…

Nvidia approaching must hold levels

Nvidia pretty much is the market. If this goes down, everything goes down, so keep it on your watchlist this week.

OK guys that it from me, have a great week!

Kieran

What did you think of this week's newsletter?Vote below and you'll be given the opportunity to leave more detailed feedback. Help improve the newsletter! |

Enjoy trading related newsletters? Try the Market Journal 👇️

Monitor prop firm payouts LIVE on Payout Junction 🔥

New here? Join Our Newsletter

Reply