- Prop Traders Weekly

- Posts

- 👀 My Forex Funds awarded $3.1 million. Case Closed.

👀 My Forex Funds awarded $3.1 million. Case Closed.

Lets get ourselves prepared for the week ahead!

Hi guys, it’s Kieran! Another week is upon us, so lets get into it.

📢 Prop Firm Industry News

The CTFC’s case against MyForexFunds is finally over. The CTFC have been ordered to pay MyForexFunds $3.1 million in legal fees. That puts an end to the biggest case that we have seen so far in the prop space. As covered previously, as soon as the new US administration came to power, a review and subsequent clean-up of the CTFC kicked off, which marked the beginning of the end of this case.

“CFTC enforcement attorneys and management engaged in numerous instances of wilful and bad faith misconduct, including making false statements to the court.”

“For the reasons set forth above, the undersigned respectfully recommends that the court grant the defendants motion for sanctions and that the complaint be dismissed with prejudice. Furthermore, the special master recommends that the defendants be awarded reasonable attorneys fees and costs associated with the prosecution of the motion for sanctions”

The CFTC originally charged My Forex Funds and its CEO, Murtuza Kazmi, with fraud in August 2023. The regulator alleges the firm collected at least $310 million in fees from its prop trading operations, with over 135,000 customers between November 2021 and the platform’s eventual shutdown.

The X account below has done a great job of covering the case these past few years, so click through if you want to read more. No statement has been made by MFF at time of writing.

So @MyForexFunds vs @CFTC is finally, and officially closed. In the end, the CFTC had to pay MFF $3.1 million in legal fees to close things out.

So why haven't they come back, paid refunds, or made some sort of announcement?

— MD Financial Skills (@MDiamondFinance)

6:57 PM • Jul 17, 2025

From Payout Junction, here are the firms who paid out the most over the last 7 days 🏆️.

🔥 Monitor prop firm payouts LIVE on Payout Junction - https://payoutjunction.com.

🕜 Red Folder News

Here are this week’s red folder news events. A relatively quiet week on the economic calendar. The biggest events of the week are US & Eurozone PMI’s, as well as US Unemployment, all being released on Thursday.

Time in CET

📈 The Macro View

Concentration risk on another level.

Top 10 companies as % of S&P 500 market cap. A handful of stocks are holding up the market. Similar to what we tend to see at major market tops. Everything is riding on Big Tech and AI.

If we get a black swan event that effects these companies, it would be game over for this market regime, and really test the global financial system.

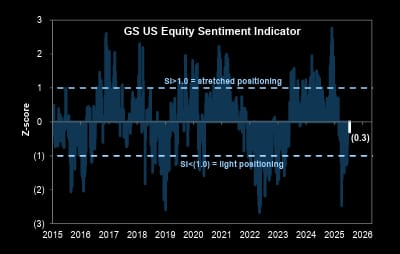

Positioning still negative

Remarkable that despite a 31% bounce of the April lows to all time highs, positioning on Goldman Sachs Prime Book is still negative. The big money continues to sit on the sidelines and watch the market melt-up. At what point does the FOMO kick in?

Seasonality….Time to take a break.

No weakness at all in the Nasdaq this month, tracking seasonality nicely. Futures green this morning. Still time for more of a run-up before we hit some chop next week if seasonality is to be respected.

The great Ethereum comeback?

With Ethereum now up +170% since April, take a look at the Ethereum to Bitcoin ratio. If this is truly a market structure shit, it might only be getting started. A Pairs trade, Long ETH/Short BTC would be the play, if so.

S&P 500 in 2008 v 2025

Shout out to ‘The Great Mantis’ on X for this incredible analogue of the S&P 500 in 2008 v 2025. Truly a reminder that anything can happen and to expect the unexpected, even when it looks like there is no risk.

S&P 500: 2008 vs. 2025🚨

No trickery, just an overlay of both years.

Scary?

— The Great Martis (@great_martis)

10:20 PM • Jul 18, 2025

Ok guys that’s it for this week, stay safe out there!

Kieran

📚 Further Reading

In what ways can a prop trader leverage automation or algorithmic tools within the rules of a prop firm challenge to gain an edge? This week’s question to PerplexityAI includes:

Expert Advisors and Algorithms

Risk Management Automation

Execution Enhancement Tools

Multi-Account Strategy Management

Click the link below!

What do you think of this week's newsleter? |

Please do me a favour and share this with other traders, your communities and on social media. I’d greatly appreciate it, thanks! 🙂

New here? Join Our Newsletter

Reply