- Prop Traders Weekly

- Posts

- 👀 NinjaTrader Prop and Tradeovate Prop launched

👀 NinjaTrader Prop and Tradeovate Prop launched

Lets get ourselves prepared for the week ahead!

Hi guys, it’s Kieran. Another week is upon us and the markets are open, so lets get into it.

📢 Prop Firm Industry News

Last week saw the launch of ‘Tradeovate Prop’ and ‘NinjaTrader Prop’. Don’t get too excited though, as after some online confusion, it became clear that these are not prop firms, but are in fact just updates for both the trading platforms, as well as new branding, aimed specifically at prop firm traders.

Both of these platform are owned by Kraken, who recently acquire Breakout Prop, so this represents a strengthening of their focus on online prop trading. Futures platforms are notoriously bad compared with CFDs, so this is highly welcome and now with ProjectX bringing fresh competition, should result in better futures platforms overall for traders.

Is Tradovate Prop a prop firm?

Nope! We exist to provide trading technology, platform infrastructure, and other tools that you can use with your prop firm of choice to support your trading journey.

Learn more about what we are (and aren't) by following Tradovate Prop.

— Tradovate Prop (@TradovateProp)

3:19 PM • Oct 2, 2025

prop.ninjatrader.com

— NinjaTrader Prop (@NinjaTraderProp)

3:00 PM • Oct 1, 2025

From Payout Junction, here are the firms who paid out the most over the last 7 days 🏆️.

🔥 Monitor prop firm payouts LIVE on Payout Junction - https://payoutjunction.com.

🕜 Red Folder News

Here are this week’s red folder news events. Due to the US Government shutdown, there remains a lot of uncertainty around what data will be announced, and when. Last week’s jobs numbers were delayed, so they have been moved onto this week’s calendar as ‘tentative’. Whether we get them or not, is a mystery, so keep an eye on news as it unfolds.

📈 The Macro View

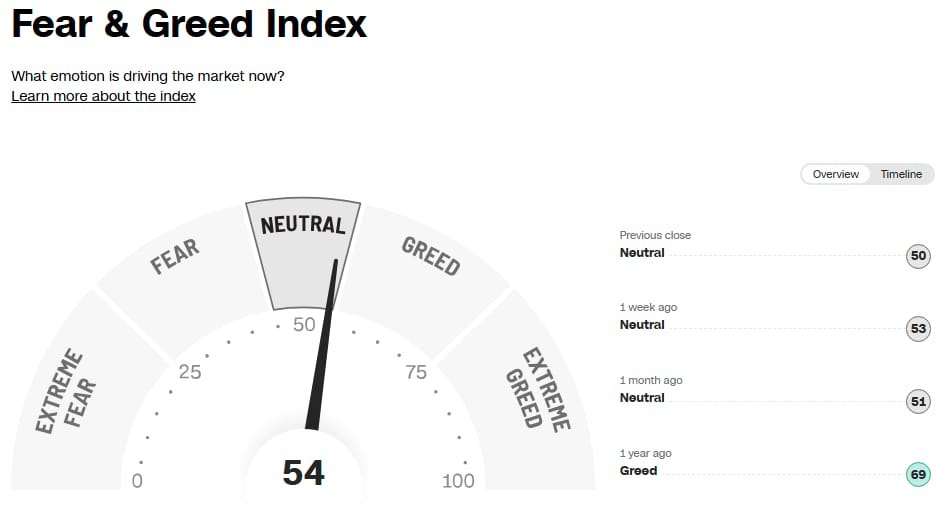

Neutral Sentiment…at all time highs

Another week, another all-time high, yet no one’s feeling confident about adding longs. It’s a strange feeling around the market where everyone assumes its can’t keep grinding higher, yet week after week it does exactly that.

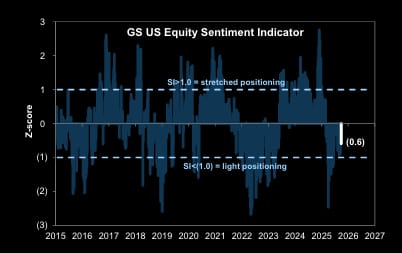

Institutions still not getting involved.

Its been the same story all year. Institutions are not buying this rally. New all time highs and they continue to watch from the sidelines. On Goldman Sach’s Prime book positioning remains ‘light’. What would it take for us to see these institutions buying?

The seasonal end of year rally starts now..

On a 20 year lookback, the S&P500 tends to rise from now until year end. We are more or less over the summer doldrums and the first week of October tends to be the time we start to see risk being added.

Goldman Sach’s end of year S&P 500 target… +7300

That’s +8% from here. It’s currently up +14% Year to date.

“Only 4 other instances where SPX is up this much at this point in the calendar (25y lookback).”

2024 was +20.3% (closed the year +24%).

2021 was +17.7% (closed the year +28.8%).

2019 was +17.1% (closed the year +28.7%).

2013 was +15.9% (closed the year +26.4%).

OK guys that’s everything from me, have a great week!

Kieran

What did you think of this week's newsletter?Vote below and you'll be given the opportunity to leave more detailed feedback. Help improve the newsletter! |

Enjoy trading related newsletters? Try the Market Journal 👇️

Monitor prop firm payouts LIVE on Payout Junction 🔥

New here? Join Our Newsletter

Reply