- Prop Traders Weekly

- Posts

- 👀 Tradesyncer copying error sparks drama

👀 Tradesyncer copying error sparks drama

Lets get ourselves prepared for the week ahead!

Hi guys, it’s Kieran! Another week is upon us and the markets are open, so lets get into it.

📢 Prop Firm Industry News

Kind of a quiet week across the industry for major news, however there is always some minor drama to report. This week it was the turn of the futures trade copier, Tradesyncer which accidentally copied the trades of someone gambling on CPI, to someone else’s account.

🚨 BREAKING 🚨

Project X has been found to use the exact same ID for different traders.

One user has found in their sleep someone gambling CPI on their account and was linked with theirs through third party software/api.

@Topstep@MichaelPatak@projectxtrading please look.

— Wepth 🧲 (@Wepth)

8:14 PM • Aug 15, 2025

@Topstep@MichaelPatak This is an error made by Tradesyncer and has nothing to do with ProjectX. They confirmed their integration with us is in 'beta', and traders should be aware of this fact when choosing their trade copier software.

— ProjectX (@projectxtrading)

10:07 PM • Aug 15, 2025

Co-founder and CEO of Tradesyncer confirmed the issue was on the Tradesyncer end, and nothing to do with ProjectX.

Anyway, this incident was fixed quickly and communicated transparently, so well done to Tradesyncer for the rapid response. Hopefully the bug is squashed for good.

From Payout Junction, here are the firms who paid out the most over the last 7 days 🏆️.

🔥 Monitor prop firm payouts LIVE on Payout Junction - https://payoutjunction.com.

🕜 Red Folder News

Here are this week’s red folder news events. Thursday sees the Fed’s annual Jackson Hole Symposium kick off, where Fed chair Powell will speak on Friday. FOMC minutes on Wednesday and US PMIs on Thursday are also potential market moving events.

📈 The Macro View

Market Sentiment remains positive.

Last week’s push to all-time highs on Tuesday was short lived, and mostly retraced by market close on Friday. The Trump/Putin summit likely weighed heavily on risk appetite, especially going into the weekend. Sentiment remains positive, slightly in ‘Greed’ territory, but nothing extreme. Equity futures opened flat this morning.

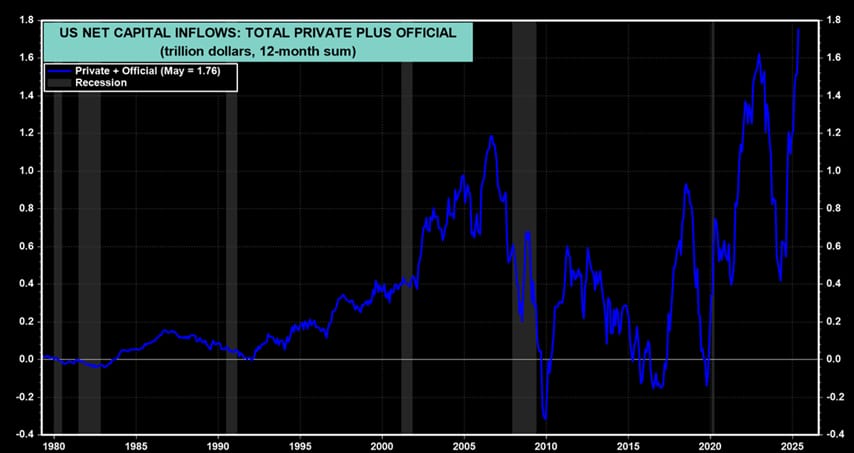

US capital inflows are unstoppable

The US has the largest and most diversified capital markets in the world. Foreign investors are attracted to the liquidity and relative safety of the US capital markets. Over the past 12 months, their inflows totaled a record $1.76 trillion, a new all-time high. It’s hard to see the equity markets turning around with such high levels of foreign capital pouring into the US.

The Ethereum bull-run is outshining Bitcoin.. Why?

Stablecoins.

Stablecoins make up 40% of blockchain fees, with over half on Ethereum. The sector is set to grow ~8x by 2028, boosting Ethereum’s fee income, as per Standard Chartered. ETH up 78% YTD. BTC up only 15%. Didn’t see that one coming at the start of the year!

OK guys that’s everything from me, have a great week!

Kieran

Heads-up - Tradeify are running an incredible 1 year anniversary special on their straight to funded accounts. Use the code PAY to get an additional 30% off their already reduced prices. A double discount! Deal ends tonight. Visit Tradeify here.

📚 Further Reading

Is it smarter to size down and focus on consistency, or size up aggressively to pass challenges faster but risk blowing accounts? This week’s question to PerplexityAI includes:

Conservative Risk Management Approach

Prop Firm Survival Statistics

Progressive Sizing Strategy

Best Practices Implementation

Click the link below!

What do you think of this week's newsleter? |

Enjoy trading related newsletters? Try the Market Journal 👇️

Monitor prop firm payouts LIVE on Payout Junction 🔥

New here? Join Our Newsletter

Reply